With recent market volatility swirling and tech stocks trailing, investors are exploring for opportunities to boost returns. The QQXT ETF, which focuses on innovative Nasdaq companies, is appearing traction as a potential solution. Will it be the right move for your portfolio?

Consider this a closer look at the QQXT ETF and its opportunity:

- {Focus on growth: The ETF tracks the Nasdaq-100 Growth Index, which highlights companies with strong revenue and earnings growth. This can be particularly appealing in a market craving high returns.

- {Sector diversification: While the ETF is heavily weighted towards tech, it also incorporates exposure to other sectors like healthcare, providing some stability against sector-specific risk.

- {Potential for outperformance: Historically, growth stocks have surpassed the broader market. The QQXT ETF's concentrated exposure to these companies may lead to stronger returns, but it also carries higher volatility.

However, it's important to evaluate both the risks and rewards before investing in any ETF. The QQXT ETF is not suitable for all investors, particularly those with a conservative risk tolerance.

Evaluating ProShares Ultra QQQ (QQXT) Results

ProShares Ultra QQQ (QQXT) is a popular exchange-traded fund that seeks to provide two times the daily returns of the Nasdaq 100 Index. Evaluating its results can be a complex task, as it involves considering various factors such as market conditions, fundamental assets, and investment strategies. Investors who are exploring QQXT should carefully review its historical results, exposure, and expense ratio.

- Key metrics to assess include the fund's deviation, bid-ask spread, and operating cost

- Furthermore, it is essential to understand the risks associated with leveraged ETFs such as QQXT, which can exacerbate both profits and losses.

Consequently, a detailed analysis of ProShares Ultra QQQ's returns should involve a combination of quantitative and qualitative considerations.

2x Leveraged Returns: Unpacking QQXT's Potential and Risks

QQXT presents investors with a unique prospect to increase their earnings through its aggressive 2x leveraged ETF strategy. By investing in QQXT, investors intend to capitalize on the potential of the broader sector, but it's crucial to appreciate the significant risks involved.

2x ETFs like QQXT dynamically aim to mirror the daily performance of their underlying assets, but with a 2x boost. While this can lead to significant gains during positive market conditions, it also magnifies losses during negative periods.

As a result, investors should thoroughly consider their risk tolerance before allocating in QQXT. A balanced approach remains website essential to minimize the potential downsides of leveraged ETFs like QQXT.

Unveiling the QQXT ETF: A Look at Leverage Strategies

The QQXT/QQXT ETF/ProShares Ultra QQQ (QQXT) has captured investor attention/focus/interest due to its aggressive/leveraged/amplified approach to tracking the NASDAQ-100 index. This ETF/fund/investment vehicle utilizes a sophisticated/strategic/complex leverage/multiplier/amplification strategy, aiming to deliver/produce/generate returns that are two times/double/multiplied by the daily performance of its underlying benchmark.

- Examining/Analyzing/Dissecting the recent/historical/past performance of QQXT reveals/highlights/demonstrates the potential benefits and risks inherent in leveraged ETFs.

- Investors/Traders/Portfolio managers seeking/aiming/pursuing exposure/participation/investment to the technology/growth/innovation sector may find/consider/explore QQXT as a tool/instrument/vehicle.

However/Nevertheless/On the other hand, it's crucial/essential/vital for investors to understand/grasp/comprehend the unique/distinctive/specific characteristics of leveraged ETFs, including their volatility/fluctuation/instability.

Riding the Tech Wave: Examining QQXT ETF Returns

With the tech sector showing phenomenal growth in recent times, investors are keenly seeking opportunities to profit from this trend. The Tech-Heavy ETF has become as a popular choice for those looking to diversify their portfolio towards the booming tech landscape. This article dives into the trajectory of the QQXT ETF, scrutinizing its advantages and potential risks.

One key factor impacting the QQXT's success is its extensive holdings in some of the largest tech companies. The ETF mirrors a carefully selected index, guaranteeing exposure to both veteran names and promising players in the tech industry.

Additionally, the QQXT ETF offers investors options in terms of buying. Its liquidity makes it convenient to join and withdraw positions, catering to both strategic and value investors.

However, it's important to acknowledge that the tech sector is inherently volatile. Economic shifts, regulatory updates, and even consumer sentiment can materially affect tech stock prices.

- Consequently, investors considering the QQXT ETF should conduct meticulous research, analyze their risk tolerance, and develop a well-defined investment strategy.

Understanding ProShares Ultra QQQ (QQXT): Managing the Ups and Downs of a Leveraged ETF

The prospect of amplified returns can be alluring for investors, but it's crucial to understand the inherent challenges associated with leveraged ETFs like ProShares Ultra QQQ (QQXT). This ETF aims to deliver double the daily performance of the Nasdaq-100 Index. While this can result in sizable gains in a bull market, it also exacerbates losses during periods of downturn.

Investors considering QQXT must thoroughly evaluate their risk tolerance and investment strategy. Due to the daily rebalancing mechanism inherent in leveraged ETFs, long-term performance can deviate significantly from the underlying index. It's essential to monitor your investments closely and be prepared for fluctuations in value.

- Don't put all your eggs in one basket

- Understand

- Focus on long-term goals

Jake Lloyd Then & Now!

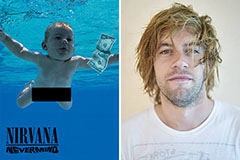

Jake Lloyd Then & Now! Spencer Elden Then & Now!

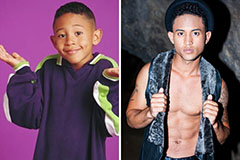

Spencer Elden Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!